923 What's our government's debt?

It's budget time and people are discussing (SMH) whether to have tax cuts or a reduction in government debt ... so, what's our government's debt? Hearing that figure was bad enough, but then I heard how much interest we're paying every day. Shock, horror! I have an essay MONEY in my book en.light.en.ment

The issue

of government debt surely is a puzzle … government debt (also known as public interest, public debt, national debt and sovereign

debt) is the debt owed by

a government. By contrast, the

annual "government

deficit" refers to the difference between government receipts and spending in a single year.

Australia's net government debt as

percentage of GDP in the 2016–17 budget was estimated at 18.9% ($326.0 billion). The budget forecasted that

net government debt would increase to $346.8

billion in 2017–18 and $356.4 billion in 2018–19.

The budget shows $16.4 billion will

be paid in interest to service liabilities for the year to June 2018. This is

approx. $1.3 billion per month, or $44 million per day. Wow!

I any case, as shocking as the

figures are, they are much lower than most developed countries. The 5 countries

with the most debt are … (US$, 2010):

|

Country

|

GDP

|

Debt as %

of GDP

|

|

United States

|

$14.6 trillion

|

92.7

|

|

China

|

$5.7 trillion

|

19.1

|

|

Japan

|

$5.4 trillion

|

225.9

|

|

Germany

|

$3.3 trillion

|

75.3

|

|

Australia (2016)

|

$0.326 trillion

|

18.9

|

As of March 2017, the U.S. debt is

about $19.9 trillion; it amounts to: $61,365 for every person living in

the U.S. The figure for AUS ist $13,075 p/p.

So why do countries have to issue

debt at all? Debt is an extremely cheap and therefore attractive form of

financing for governments … they're able to borrow at incredibly low interest

rates, invest in infrastructure, and produce a positive return on investment

from that debt.

A person can have both debts and

investments at the same time. For instance, many people have their home mortgages

while at the same time investing in the stock market. Corporations do the same

and same for governments. The key here is to stay float (keep debts below

assets).

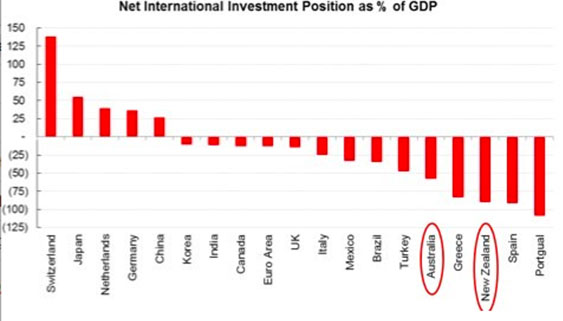

What is important here is not the

"External Debt" statistic, but the Net

international investment position (NIIP) that measures a country's

investments minus debts. As you can see, some countries have a large investment

while other countries have a large debt. By that measure Australia's position is not all that good after all.

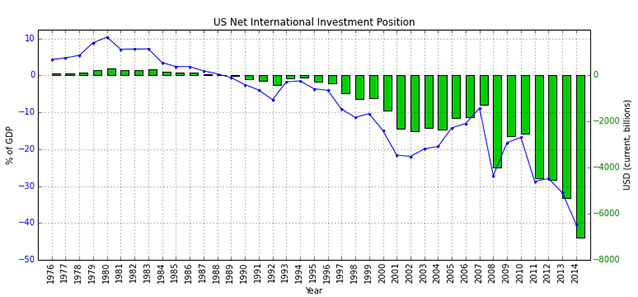

This is what it looks like for the US: